Best Forex MACD Alert Indicators 2023 For MT4 Download Free

Contents

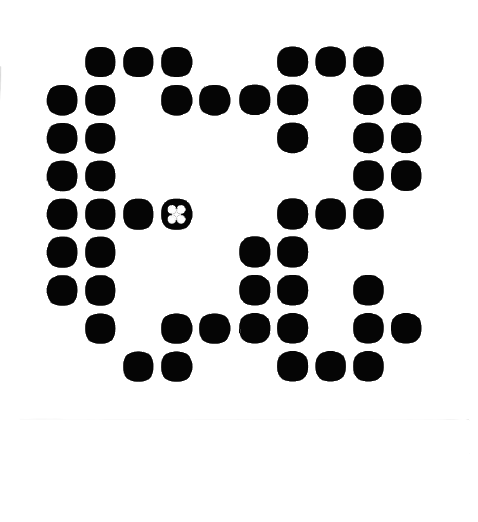

Divergences might signal a trader to get out of a long or short position before profits erode. Notice in this example how closely the tops and bottoms of the MACD histogram are to the tops of the Nasdaq 100 e-mini future price action. A potential buy signal is generated when the MACD crosses above the MACD Signal Line .

Nevertheless, the indicator can demonstrate whether the bullish or bearish movement in the price is strengthening or weakening and help spot entry and exit points for trades. A MACD positive divergence is a situation in which MACD does not reach a new low, despite the fact that the price of the stock reached a new low. The relative strength index aims to signal whether a market is considered to beoverboughtoroversoldin relation to recent price levels. The RSI is an oscillator that calculates average price gains and losses over a given period of time.

What are the limitations of the MACD?

MACD measures the relationship between two EMAs, while the RSI measures price change in relation to recent lows and highs of prices. These two indicators are mostly used together to give traders and analysts a more complete technical picture of a market. The relative strength indicator seeks to indicate if a market is overbought or oversold ctpartners news in relation to recent price levels. The RSI is an oscillator that calculates average price gains and losses over a given time; the default time period is 2-week periods with values bounded from 0-100. MACD helps reveal subtle shifts in the strength and direction of an asset’s trend, guiding traders on when to enter or exit a position.

Chartists looking to get more sensitivity may try a shorter short-term moving average and a longer long-term moving average, and might be better suited for weekly charts. The moving average convergence divergence is a technical indicator that shows the relationship between two moving averages of an asset’s price. Its purpose is to reveal changes in a trend’s direction, strength, momentum, and duration in the underlying security’s price.

- Our mission is to provide clients and partners around the world with the opportunity to become successful in the financial markets.

- Stocks are up 16% since then, due in part to many investors anticipating that the Fed might not raise rates as aggressively as previously expected due to inflation having potentially peaked.

- The default time period is 14 periods with values bounded from 0 to 100.

Alternatively, if the MACD line crosses below the signal line, this may be interpreted as a sell signal. MACD is a technical indicator that can generate buy-and-sell signals. The next chart shows 3M with a bullish centerline crossover in late March 2009 and a bearish centerline crossover in early February 2010. In other words, the 12-day EMA was above the 26-day EMA for 10 months. Below is a chart of Cummins Inc with seven centerline crossovers in five months. In contrast to Pulte Homes, these signals would have resulted in numerous whipsaws because strong trends did not materialize after the crossovers.

When the market is trending, it is important to keep in mind that the trend will eventually begin to exhaust. In an uptrend, as shown in our example with EUR/USD, when there is a bearish crossover, it could be a sign that the momentum of the uptrend is slowing down and the pair may change its direction. That’s why it’s essential to understand the nature of the simple moving average and the exponential moving average . It’s also worth mentioning that a reversal in the trend can be expected when the histogram moves over the zero-line. Horizontal resistance red line is the all time highs of Spring 2018.

Advantages of MACD

The shorter moving average (12-day) is faster and responsible for most MACD movements. The longer moving average (26-day) is slower and less reactive to price changes in the underlying security. The demerit of applying the indicator is that it is very notorious for causing whipsaws in traders. Whipsaws can be prevented by not using the MACD as the major indicator of trade signals.

You should consider whether you can afford to take the high risk of losing your money. This bearish divergence acted as an early warning sign of things to come with the E-mini S&P 500 futures contract. This occurs because the MACD is accelerating Bullish Engulfing Pattern Definition faster in the direction of the prevailing market trend. A possible buy signal is generated when the MACD crosses above the zero line. This is seen on the Nasdaq 100 exchange traded fund chart below with the two purple lines.

Even though it is an oscillator, it doesn’t print overbought or oversold conditions (as it’s unbounded). It shows up on the chart as two lines which oscillate without boundaries. The crossover of the two lines produces trading signals similar to a two moving average system. The xm pip value is considered to work best in trending markets. This limits its use for traders depending on their trading strategies. For example, range bound/consolidating markets will generally give flawed signals when using the MACD.

Centerline crossovers

This bullish crossover suggests that the price has recently been rising at a faster rate than it has in the past, so it is a common technical buy sign. The Moving Average Convergence/Divergence indicator is a momentum oscillator primarily used to trade trends. Although it is an oscillator, it is not typically used to identify over bought or oversold conditions. It appears on the chart as two lines which oscillate without boundaries.

In the example above, the yellow area shows the MACD line in negative territory as the 12-day EMA trades below the 26-day EMA. The initial cross occurred at the end of September and the MACD moved further into negative territory as the 12-day EMA diverged further from the 26-day EMA. The orange area highlights a period of positive MACD values, which is when the 12-day EMA was above the 26-day EMA.

MACD: A Primer

When a stock, future, or currency pair is moving strongly in a direction, the MACD histogram will increase in height. Traders get valuable insight from the MACD in the form of potential buy and sell signals. Another potential buy and sell signal is shown in the graph above in the Nasdaq 100 exchange-traded fund QQQQ chart. MACD is calculated Everything You Need To Know About Taxes On Stocks by subtracting the long-term EMA from the short-term EMA . An EMA is a type ofmoving average that places a greater weight and significance on the most recent data points. Full BioBrian Dolan’s decades of experience as a trader and strategist have exposed him to all manner of global macro-economic market data, news and events.

Moving average convergence/divergence is a momentum indicator that shows the relationship between two moving averages of a security’s price. As mentioned earlier, the MACD indicator is calculated by taking the difference between a short-term moving average (12-day EMA) and a longer-term moving average (26-day EMA). Given this construction, the value of the MACD indicator must be equal to zero each time the two moving averages cross over each other. It has become standard to plot a separate moving average alongside the MACD, which is used to create a clear signal of shifting momentum. A signal line, also known as the trigger line, is created by taking a nine-period moving average of the MACD.

Biggest mistakes to avoid with the MACD

Therefore, to mitigate risk and confirm the signals further, traders should use the MACD in tandem with additional indicators, such as the RSI indicator. A bullish crossover happens when the MACD line crosses above the signal line signifying an entry point for traders . Conversely, a bearish crossover occurs when the MACD line crosses below the signal line presenting as an exit point . Crossovers can last a few days or weeks, depending on the movement’s strength.

Below we see Gamestop with a large bearish divergence from August to October. The stock forged a higher high above 28, but the MACD line fell short of its prior high and formed a lower high. The subsequent signal line crossover and support break in the MACD were bearish. On the price chart, notice how broken support turned into resistance on the throwback bounce in November . This throwback provided a second chance to sell or sell short.