What is Forex Trading ? Ways of Forex Trading

Contents

Indian traders can legally sign up with any Forex broker based anywhere in the world, regardless of their regulatory status. The exchange rate is the rate at which you can trade one country’s currency with that of another. Most exchange rates are volatile and can rise or fall with the change in the demand and supply forces of the market. The Trends in Price Action Trading can be determined over various timeframes such as short-term, medium-term, and long-term.

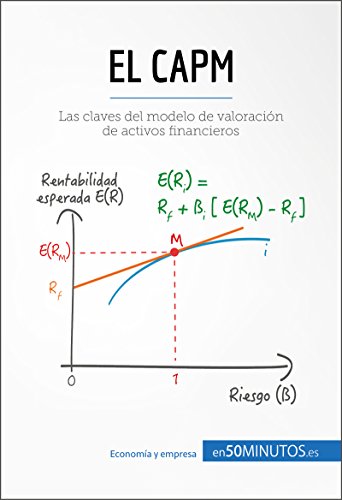

However, forex, like other financial markets, is largely controlled by supply and demand dynamics, and it is critical to grasp the variables that drive price changes here. While some foreign exchange is done for practical reasons, the great majority of currency conversion is done to make a profit. Because of the volume of money exchanged each day, the price fluctuations of some currencies can be very volatile. This unpredictability is what makes forex so appealing to traders. Forex, or foreign exchange, may be defined as a network of buyers and sellers who exchange currencies at an agreed-upon price. Hence, Foreign currency trading is the process through which people, businesses, and central banks exchange one currency for another.

Spreads between the purchasing and selling prices are how they generate money instead. NTA®provides live training and trading learning session to the individuals who are interested in the stock market and are more focused on the technical analysis for the stocks and specialized in intraday trading. We had different kinds of courses that are mentioned on our website. Through this blog, term sheet negotiation you will get in-depth knowledge aboutwhat is forex trading,how to trade forex& pros and cons of trading forex. If in case, you have some doubts or queries regarding the blog or about the courses you can call or email us. Many of the foreign exchange is done for practical purposes, the majority of the trade for currency conversion is undertaken for the motive of earning a profit.

Practice with virtual trading

Forex trading can make you wealthy if you are a hedge fund with deep pockets or an exceptionally skilled currency trader. Retail traders, however, may find forex trading to be more of a rocky path to huge losses and potential poverty than a road to riches. Even beginners with little experience can find forex a desirable market for several reasons. To participate in the forex market, traders need only deposit a small amount of money. Additionally, the market is open 24 hours a day, 5 days a week . Highly volatile foreign exchange rates demand hedging of the same.

Kindly exercise appropriate due diligence before dealing in the securities market. The Indian Forex market is regulated by SEBI and follows the ‘Forex Trading in India RBI Guidelines’. As per RBI’s Liberalised Remittance Scheme, an individual is not permitted to provide margin money for https://1investing.in/ trading or use the money transferred abroad for speculative purposes. Forex trading in India is not allowed in cash for retail investors. In India, currency trading is facilitated on the National Stock Exchange, the Bombay Stock Exchange & the Metropolitan Stock Exchange of India Ltd.

Large volumes of currencies are traded on the international interbank market in Zurich, Hong Kong, New York, Tokyo, Frankfurt, London, Sydney, Paris and other global financial centers. This means that the interbank market is always open – when the working day ends in one part of the world, banks in the other hemisphere have already opened their doors and the trade goes on. In July 1944 more than 700 representatives from the Allied nations brought forward the importance of a monetary system which would fill the gap left behind the gold standard. They arranged a meeting at Bretton Woods, New Hampshire, to set up a system that would be called the Bretton Woods system of international monetary management.

How do you trade Forex markets?

For those with insane focus, he adds, there is virtually no price to pay as they love what they are doing. That by submitting the above mentioned details, you are authorising Kotak Securities & its sub-brokers & agents to call you and send promotional communication even though you may be registered under DNC. Currencies such as the Thai baht or Swedish kroner are also traded. But such trade usually involves a greater degree of risk and volatility. Any Grievances related the aforesaid brokerage scheme will not be entertained on exchange platform.

Forex is a decentralized global market where all the world’s currencies are traded against each other, and traders make a profit or loss from the currencies’ value changes. Forex Market is also known as Foreign Exchange Market, FX or Currency Trading Market. Forex trading is high-risk, so brokers who require new traders to deposit large amounts are less favourable. While it is almost impossible to start a trading career with as little as $5, brokers who have entry-level accounts that require less than $100 are good for beginners. We have aguide full of practical advice to get you started, and more onhow to place your first trade. It will take some time to learn how to trade Forex successfully, as traders need to understand the many components and strategies to be profitable.

Risk is inevitable, but can be covered through Hedging

It accepts no liability for any damages or losses, however caused, in connection with the use of, or on the reliance of its product or related services. And, as many of them grew up, there seemed a curiosity to find out the connection between one currency to that of the rest of the world. This concept revolves around trading foreign currency, also known as Forex trading. Can you recall the times when you used to collect notes and coins as a child? Mostly, back then, children were more inclined toward foreign currency. Right from the signature to the colour, everything seemed to give a twinkle in the eye.

But if you are interested, we welcome you to jump start now. Our goal is to create high-quality, factually correct, and meaningful educational content that furthers our readers interest in trading and education. It is free from commercial bias, conflict of interest and as accurate as our writers are able. When you sign up for an account through our links, we sometimes earn a commission, which enables us to continue making our website better for you.

- That by submitting the above mentioned details, you are authorising Kotak Securities & its sub-brokers & agents to call you and send promotional communication even though you may be registered under DNC.

- This is because RBI is the custodian of India’s foreign exchange reserves, and thus has been vested with the responsibility of managing the forex market.

- And RBI does allow cross currency pairs to be traded in the derivatives market in India.

- Forex trading in India is only possible through derivatives like futures, options, swaps, and others.

That said, India’s market hours for forex trading are 9.00 AM to 7.30 PM. What many refer to as the forex market is a diverse marketplace that’s home to equally diverse types of traders. The type of trading that you’re interested in involves buying and selling exchange-traded derivatives. In forex trading, you buy one currency while simultaneously selling another one. For instance, say, you are trading in a major pair like GBP/USD (British pound/dollar). Here, the exchange rate reflects the number of US dollars you can buy with one British pound.

Be a part of the 5paisa community now with 10 million mobile app users

The Forex markets move fast, very fast, and if your connection is slow or drops out you are going to lose money. Winning trades can become losing trades in the blink of an eye. Many Indians trade on their mobile phones, but this should be used as a backup and not as a primary trading platform.

In fact, the forex market is completely online and is connected via the internet, trading terminals, and brokers. Forex trading in India is only possible through derivatives like futures, options, swaps, and others. If you trade stock derivatives, you can take delivery of the underlying shares into your Demat account on expiry. Keep an eye out on volatility and liquidity when you strategise your moves.

Many investors are surprised by the magnitude of the forex market, which is the world’s largest financial market. According to the 2019 Triennial Central Bank Survey on FX and OTC Derivatives Markets, the average daily traded volume is $6.6 trillion. On the other hand, the New York Stock Exchange trades an average daily volume of a little over $1.1 trillion. The uniqueness of forex trading is that almost every broker has demo accounts – the ideal forum to learn. This means you can practice without having to spend your own money. Timing, volatility trend or economic growth can be convenient to choose a pair.

Many traders come into the market and consider it as a money-making machine, which is not a wise thing to do, he says. Born in Farmingdale, New York, Lipschutz began his trading career while attending Cornell University. He has a bachelor’s degree in fine arts and completed his MBA in finance in 1982. Lipschutz’s education background has undoubtedly contributed to his success in the forex market.

Bid and ask prices are available to market participants at any time, except when the market is closed. The trader receives quotes via the Internet from the broker who provided him with a trading account. In turn, the brokerage firm receives price quotes from its liquidity providers, i.e. banks.

Most brokers also offer their custom-built platform for trading forex. You can access them online or install them on your smartphone. These are the most used and good Forex trading strategies that a trader can use along with technical and fundamental analysis.